Intellectual Constipation

“If you can’t convince them, confuse them”. Though originally used by Mr. Harry Truman in the context of contemporary politics of his opposition, the quote has become popular to represent an effective salesman. Whether one is selling a product, or a service or an idea.

Over the years, the overzealous service providers, in the attempt of tapping newer customers, have been reaching out to budding entrepreneurs. These entrepreneurs are mostly first time seeking an outside loan through a third party advisor. For them the whole gamut of activities and documents like Information Memorandum, CMAs, NDAs, Power Point Presentations simply bogg them down.

We have met many successful entrepreneurs (of sizeable business turnover of Rs. 25-50 Crores) getting confused with an unsigned Term Sheet as a final sanction letter. Few other MSME promoters are found to be excited to have signed the NDA with the foreign investor as a done deal. (Although there is not a single piece of information flowing from the Investor to the Promoter, it is the Promoter who is compelled to sign and accept the liability of such information.)

We have seen promoters happily sending all the details and project reports to such foreign investor who has approached them “Directly”. But the same promoters are hesitant in sharing basic information to their existing banker !

In fact, a certain set of entrepreneurs readily send across their PAN, ITR and Aadhar Card on whats app as an application for loan, but don’t want to share a summary of their project report !

They are TOLD that the NRI funding (private funding from foreign investors) is cheaper money (because NRIs get 1% in their savings bank so they can lend to us at 4% etc.). And such funding is less risky for the Promoter compared to the loan.

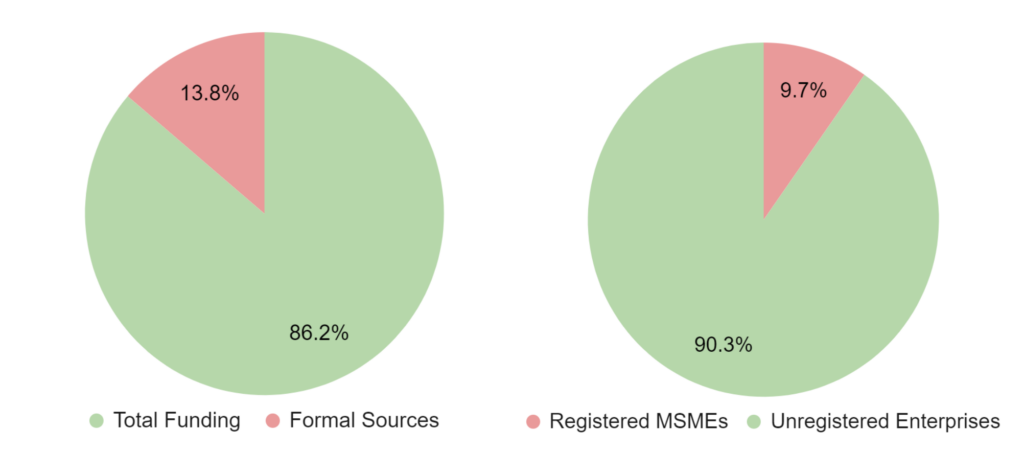

As we have seen in an earlier blog, 90% of the MSME are unorganised and about 85% of funding needs of MSMEs is catered to by the informal financiers. (friends, families and private lenders where the interest rates are found to be as high as 30% – 200% p.a.). Hence, it is not a wonder that few energetic promoters get attracted to such “4% p.a.” foreign funding.

When we tell upfront a particular offer by a financier is not doable or legally tenable, no matter how attractive it may appear, the entrepreneur tends to discount us away saying we are not having sufficient knowledge about it.

So what is the solution? We need to get more MSME in the organised sector and get more funding needs addressed under the formal financing mode.

Well, on the front of formalising the funding needs, a revolution is already happening under the digital lending which has enabled faster loan disbursal to even far flung areas. Digital lending has grown from $9 billion in 2012 to $110 billion in 2019 and is likely to shoot up to $350 billion by 2023.

Apart from the funding aspect, the awareness aspect is equally essential to remove a lot of mis-conceptions and stigma around the formal funding. The entrepreneurs have been willy-nilly accumulating a lot of bits and pieces of information about the finance and accounts and they tend to have reached Intellectual Constipation about this subject.

We need to have a shot of laxative to cleanse the system – just forget all the intricate processes and jargons and start in simple steps ?

- How much money we need (have a business plan and its end use clearly laid down !)

- Who is giving money (Is it bank or NBFC or an equity fund ?)

- What is the nature of this funding – Loan or equity partnership ? Loan needs to be repaid, Equity partners would share losses.

- What are the key terms – tenor, interest/principal and its schedule. And is it imposing any conditions on the conduct of business.

- What is the security – core security and collateral

Entire 100-200 page of funding agreements (known as Facility Agreement) can be summarized on these 5 points. In fact, the starting point of any funding discussion should be these 5 bullet points.

The deal/funding structure can be as complex as it may, but the key aspects would not go beyond these 5 discussion points.

Comments are closed