Via Negativa

Knowing what we DON’T know is more important than knowing what we DO know. So goes the saying by Marathi Saints.

आपल्याला काय कळतय यापेक्षा, काय कळत नाही, हे कळणे फार महत्वाचे

The theory of Via Negativa was originally used in the debate on the existence of God. The proponents of the Via Negativa method of explanation postulated that, since God transcends so many forms, it is difficult to list all those instances. Instead, they proposed the negative route – to list where all places/forms the God DOESN’T exist.

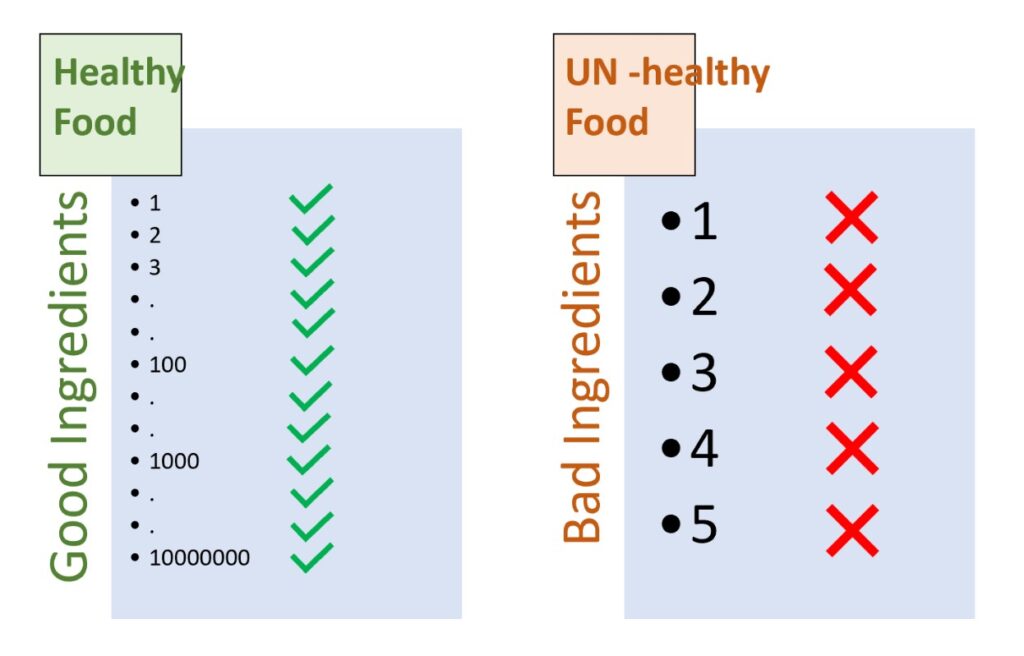

We would be able to appreciate the theory in a much easier way in the context of a simple business situation. When we get down to define a healthy food product, we can start by listing the good ingredients. However, there is no end to such good ingredients. Another way would be to list all those UN-healthy ingredients. Those would be still more in number, but still lesser than the list of good ingredients. So once we ensure that our proposed healthy food product has none of these UN-healthy ingredients, we arrive at a healthy product.

I came across the concept of the Via Negativa in the Book the Art of Thinking Clearly by Rolf Dobelli. There are certain references to it in the book – Thinking Fast and Slow by Daniel Kahenman.

However, a much more elaborate treatment is given by Nassim Nicolas Taleb – in his book AntiFragile. While reading Nassim’s earlier books- Skin in the Game, Black Swan or Fooled by Randomness, one gets to know how much a man can get clarity of thoughts on the subject as arcane as probability. The art of explaining an arcane subject in the most simplistic manner so that anyone can understand, is something very few could master. And Nassim is one among such few.

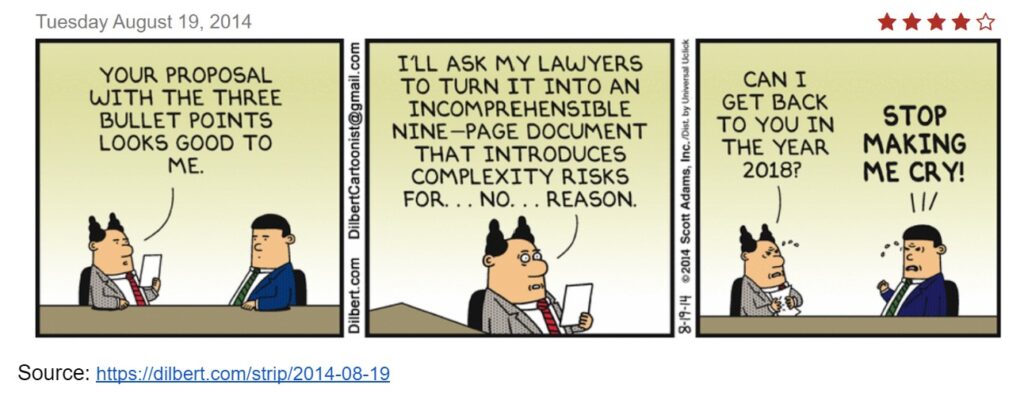

While talking with budding entrepreneurs, startup founders, established medium size businessmen, I realised that there is so much mis-information or excess information bombarded at by various stakeholders, they simply get bogged down when it comes to finance or legal aspects . Or maybe they have successfully been confused by vested interests.

For subjects of their interest – like engineering, procurement etc, the promoters seem to be keenly interested. However, when it comes to business finance, the same people tend to rely fully ( and in certain cases, blindly) on external financial experts / accountants. So, the key aspect of business – finance – which is the very purpose of existence of a business, is left to outsiders without proper involvement of the founder. Sorry, “how to save tax” discussion with your accountant can’t be counted as involvement.

An entrepreneur can leave technical expertise to someone else, but he needs to understand the basics of finance himself. I am referring to only basics. Not the clauses of GST or Companies Act, or force majeure clauses the loan agreement. I am only referring to the basics.

And may be due to the aura created around the funding, a phobia is developed in the minds of entrepreneurs of MSME. They are so much averse to getting into the details of financing and documents that they blindly rely on the outside consultants.

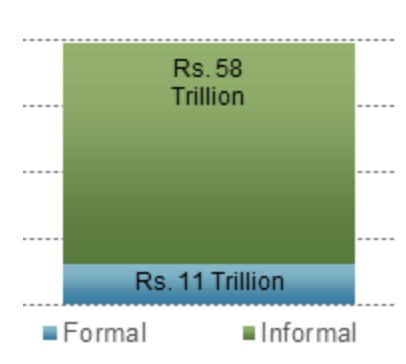

As per the Ministry for MSME, about 90% of MSMEs are unorganised in nature. And as per the IFC study, as high as 85% of the funding needs of MSMEs are catered to by the informal funding sources (friends, families and private financiers). This in spite of the fact that the government recognises the importance of the MSME and their contribution to GDP (29%) , exports (42%) and employment (45%).

The Minister for MSME has envisioned increasing the GDP contribution of MSME from 29% currently to 50% by 2025.

I feel there is a void in the whole MSME funding space which needs to be addressed from both Supply (lenders and investors) and Demand Side (borrowers, entrepreneurs).

Our attempt is to feel and fill that gap by approaching business finance in a much simpler way.

Via Negativa.

Comments are closed